MONEY DIARY: “I tried a no spend challenge - and failed. But here’s why it was still worthwhile.”

Plus these are my top tips for someone looking to try the challenge themselves

After months of high energy bills over the winter, and with April being the month when it seems like all my bills are going up, including my broadband, mobile phone and council tax, I decided I needed to try to save some money to ease the pressure on my budget. So I decided to try a no spend week to test the waters and see if I was up to the challenge of a no spend month.

A no spend challenge is exactly what it sounds like, but there are a few expenses that are ‘allowed’ such as your rent or mortgage, essential bills like council tax, energy and phone/internet, and money for food. But it’s a complete cut back on non-essential spending like clothes, online shopping and eating out.

Some hardcore adoptees of the challenge go as far pausing any gym memberships or TV subscription, but for me, I couldn’t bring myself to part with my Disney+ subscription even for a week, so I grouped that in as an essential spend. (If you count TV streaming as essential too, check out these ways to save on Netflix, Amazon Prime and Disney+). Instead, I decided I wasn’t going to use my car unless I absolutely had to, saving on fuel costs.

How did I get on?

The first couple of days of the challenge felt like a walk in the park. I was working from home during the day, my cupboards were fully stocked and I spent a couple of evenings decluttering my wardrobe, so I didn't have too much downtime to think about spending on any non-essentials.

But as soon as downtime came around midweek, far too quickly and seemingly without conscious thought, I was browsing on my phone and adding things to baskets, although I did manage to stop myself before I checked out.

There was also the FOMO that came with turning down a trip to the pub with friends, but once I told them about the challenge I’d set myself, they decided to rearrange.

Then Friday night hit, and I was looking in my fridge thinking nothing looked appetising and that it would all taste like cardboard (my logical mind realises that wasn’t actually the case, and I could have easily made a nutritious meal), but I was so tempted to order a cheeky takeaway. Again I resisted, but I was surprised at how strong the temptation was.

GoodtoKnow Newsletter

Parenting advice, hot topics, best buys and family finance tips delivered straight to your inbox.

But the absolute hardest part of the challenge came right at the end, when I looked after my three year old nephew for the day. I had planned a few free activities we could do outdoors, and thought it would be a breeze. But the weather was awful and my outdoor plans would have been totally miserable, and I was under-prepared and so ended up caving and paying for entry to the local soft play, buying a drink and snack for each of us.

While I only failed on one day of the week-long challenge, the temptation was strong, and I don't think I would have had the willpower to take on a month long challenge.

What I learned from the no spend experience

While I only managed six days of a seven day no spend challenge, ultimately the experience was absolutely worth it. It shone a light on just how mindless (as opposed to mindful) I have been when spending, and that needs to change if I want to spend less. I could also feel the thoughts forming of what I planned to buy as a 'reward' once the challenge was over, which would have undone a lot of the benefit reaped from taking on the challenge.

I became more aware too of habits I'd formed that I needed to kerb. Any downtime in front of the TV was usually coupled with endless scrolling of shopping apps, and the convenience of having payment information stored, just made it all too easy to go on to buy stuff I didn’t really need. I'm going to try leaving my phone in another room to avoid that in future.

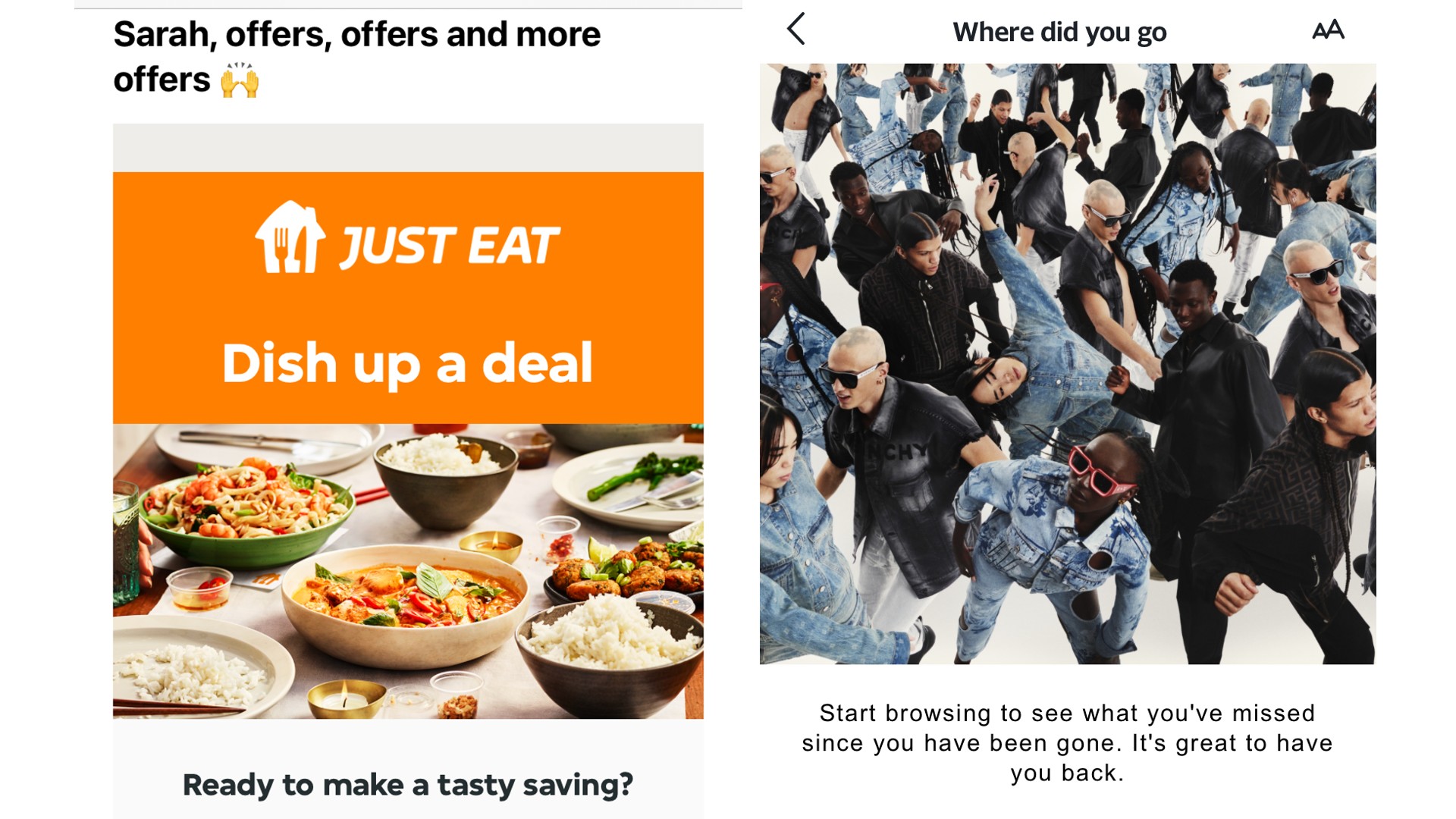

I was also surprised by just how much temptation was around - during the week, I must’ve had six or seven emails or phone notifications encouraging me to spend, offering me special deals or highlighting that items I have in my wish list are now back in stock.

I would definitely unsubscribe from these emails if I tried a no spend challenge again as they prove incredibly tempting for me

If I did this challenge again, or did it for a longer term, I would definitely turn off these notifications or unsubscribe to these emails to keep me focused on my goal.

I also realised that I rarely need much persuading to opt for a takeaway instead of cooking at home, but this was a really expensive way to eat. So now I’m going to make a real effort to try these homemade takeaway ideas instead. And while a rare treat is a good thing, I’ll make sure I try these cheap takeaway ideas to keep costs down.

My tips to someone looking to try the no spend challenge

- Start small. Start with a weekend and build up.

- Temporarily delete shopping apps and unsubscribe from their email lists to avoid temptation.

- Be prepared. Planning ahead will be essential to success, especially if you have children

- Tell your friends and family what you are attempting. It’ll help them understand if you decline invitations, and they might even join in too and you can give each other moral support.

- Don’t be too hard on yourself if you can’t manage it. Consider the goal to be becoming more mindful about what you spend and clearly defining the difference between needs and wants.

Sarah is GoodtoKnow’s Money Editor. After Sarah graduated from University of Wales, Aberystwyth, with a degree in English and Creative Writing, she entered the world of publishing in 2007, working as a writer and digital editor on a range of titles including Real Homes, Homebuilding & Renovating, The Money Edit and more. When not writing or editing, Sarah can be found hanging out with her rockstar dog, getting opinionated about a movie or learning British Sign Language.

-

How to save money: 28 family-friendly money-saving tips for mums and dads

How to save money: 28 family-friendly money-saving tips for mums and dadsUnderstanding how to save money is key to limiting the impact of rising costs as much as possible

By Sarah Handley

-

14 hidden benefits of your Amazon Prime membership

14 hidden benefits of your Amazon Prime membershipWe reveal the less-obvious perks of a Prime membership that will help you get the most value out of your subscription fee

By Rachel Wait

-

14 surprising ways to spend your Tesco Clubcard vouchers - from restaurants and cinema passes to mini breaks and Disney+

14 surprising ways to spend your Tesco Clubcard vouchers - from restaurants and cinema passes to mini breaks and Disney+Tesco Clubcard vouchers can help you cut the cost of everything from groceries and travel to days out and cinema tickets

By Heidi Scrimgeour

-

How to get Disney+ for free and save up to £79.90 a year

How to get Disney+ for free and save up to £79.90 a yearEven though the streaming giant ended its free trial offering, there are still multiple ways you can get Disney+ for free for up to 12 months

By Sarah Handley

-

Parents of teens who have just taken their GCSEs urged to check child benefit status ahead of August deadline

Parents of teens who have just taken their GCSEs urged to check child benefit status ahead of August deadlineWith a child benefit deadline looming, some parents could see their payments reduced or stopped altogether - here's why

By Sarah Handley

-

Parents should hold off buying this back to school staple 'as close to their first day as possible', says retailer

Parents should hold off buying this back to school staple 'as close to their first day as possible', says retailerWith parents turning their attention to kitting their kids out for the new school year, research suggestions which items should be left until the last minute

By Sarah Handley

-

7 ways to save on back to school essentials, as its revealed parents will spend £2.3 billion in 2024

7 ways to save on back to school essentials, as its revealed parents will spend £2.3 billion in 2024We share ways you can get your child all the bits and bobs they need for the new school year, without breaking the bank

By Sarah Handley

-

What day is child benefit paid around the bank holiday? Everything parents need to know

What day is child benefit paid around the bank holiday? Everything parents need to knowKnowing which day child benefit is paid when it comes to the bank holiday can help families plan their budgets accordingly

By Sarah Handley