1p savings challenge: how parents can save £667.95 in 2025 and how your kids can join in

By using the 1p savings challenge you could save almost £700 in just 12 months for your family

Rachel Wait

The 1p savings challenge is an easy way to help families get into the savings habit and the new year is the perfect time to start.

In fact, the 1p savings challenge could help boost your bank balance by almost £700 by the end of 2025. This could be invaluable to families at a time when the cost of living is still high and knowing how to save money for your family's future can be challenging.

GoodtoKnow's Money Editor Sarah Handley says: "The thought of saving money when costs are high can feel really daunting, but if you aren't regularly putting money aside, then a savings challenge can be a great way to get you into the habit of saving."

When it comes to cash savings, one in 10 UK adults (five million people) have less than £100 to put away, and one in six (nine million people) have no savings at all, according to research from the Money and Pensions Service. If that sounds like you, then this challenge is an easy way to get into the habit of saving little and often.

What is the 1p savings challenge and how does it work?

The 1p savings challenge involves saving little and often over the course of 12 months. On day one, you start by putting 1p aside, then you save 2p on day two, 3p on day three, and carry on in this way, saving an extra penny a day every day for a year. The amount you save goes up each day. The most you save will be on the final day, day number 365, when you put in £3.65. It really is as simple as it sounds. It's an easy way to kick start a regular savings habit.

The traditional way to do the challenge is to start on 1 January and finish on 31 December, but there are no hard and fast rules. You can start the 1p savings challenge any day of the year. The most important thing is to keep going! You can always try and get the whole family involved too.

How much money could I save by the end of the challenge?

If you stick to the 1p savings challenge and save an extra penny every day for a year, you will finish the year with a savings pot worth £667.95, based on a 365 day year.

Parenting advice, hot topics, best buys and family finance tips delivered straight to your inbox.

Here’s a table to show how those monthly savings start to stack up.

| Month 1 | £4.96 | Month 7 | £225.78 |

| Month 2 | £17.70 | Month 8 | £296.46 |

| Month 3 | £40.95 | Month 9 | £374.01 |

| Month 4 | £72.60 | Month 10 | £463.60 |

| Month 5 | £114.76 | Month 11 | £559.45 |

| Month 6 | £164.71 | Month 12 | £667.95 |

A big part of the fun is ‘ticking off’ those daily savings, and there are lots of websites including MoneySavingExpert and Skint Dad where you can download and print off a ‘tick’ sheet. This helps you keep track of where you are in the challenge, and if you miss a day, it’s easy to spot, and you can top up your fund the next day.

Director at Love Savings Group, Adrian Yearwood, says: “We all love a good saving, but saving is not always easy. With the 1p savings challenge, saving is painless.”

You could even do the challenge in reverse. This is especially useful if you start in January as it means you’re paying less into the savings pot in the lead up to Christmas.

How should I save the money during the 1p savings challenge?

There are no rules on where you should save with the 1p savings challenge. Some people prefer using a large glass jar, as this way you can see those savings start to stack up, which acts as an incentive to keep going.

However with more of us going cashless these days, for some it may be easier to do the challenge online. An online option might also be preferable for those who think they will be tempted to dip into the large glass jar throughout the year.

You could put it straight into a savings account. If you're on a low income, it's a good idea to see if you qualify for the Help to Save scheme where you can get a government boost on your savings up to £1,200.

Rather than making small daily deposits (which your bank may not actually allow), you might want to just transfer the money to your savings account once a month. The amount will vary each month - if you wanted to save this way, this is how much you will need to save each month:

| Month 1 | £4.96 | Month 7 | £61.07 |

| Month 2 | £12.74 | Month 8 | £70.68 |

| Month 3 | £23.25 | Month 9 | £77.55 |

| Month 4 | £31.65 | Month 10 | £89.59 |

| Month 5 | £42.16 | Month 11 | £95.85 |

| Month 6 | £49.95 | Month 12 | £108.50 |

But if you're busy with family life and just want a super simple option, the easiest way to tackle the challenge is to set up a standing order to transfer £55.67 per month into your savings account. This equally splits the total you would save during the challenge by 12. By doing this, you will actually end up with £668.04 by the end of the year.

Money expert Joseph Seager of Thrifty Chap says: “Automatic transfers are the best when doing any savings challenges as you don't have to physically do anything once it's all set up. You can just enjoy life knowing that your challenge is happening and your dedicated savings account (with the best possible interest!) is filling up.”

You can pop into your local branch or speak to your bank on the phone if you need help setting up a standing order.

You could also consider investing your savings in a stocks and shares ISA. Thrifty Chap’s Joseph Seager says: “Even though saving accounts have seen rising interest rates, you could still see your money grow more by paying into a stocks and shares ISA. These are long-term savings and you should only invest money you are happy to lock away for a minimum of five or 10 years.

“Just like all investments, they can rise and fall and you might get back less than you invested, but if you look at the past performances of your stocks and shares ISA provider, you can see just what is possible with the cash you put away.” ISAs are tax-efficient, so any income you make from them is tax-free.

How can children join in the 1p savings challenge?

Children can definitely get on board with the 1p savings challenge - it's totally adaptable and is a brilliant tool to teach kids about money. One easy way to do this is by encouraging them to put aside just one penny a day for a whole year, which will give them £3.65 at the end of the 12 months. To encourage them to save more, you could increase this to 10p a day, which would give them £36.50 after one year.

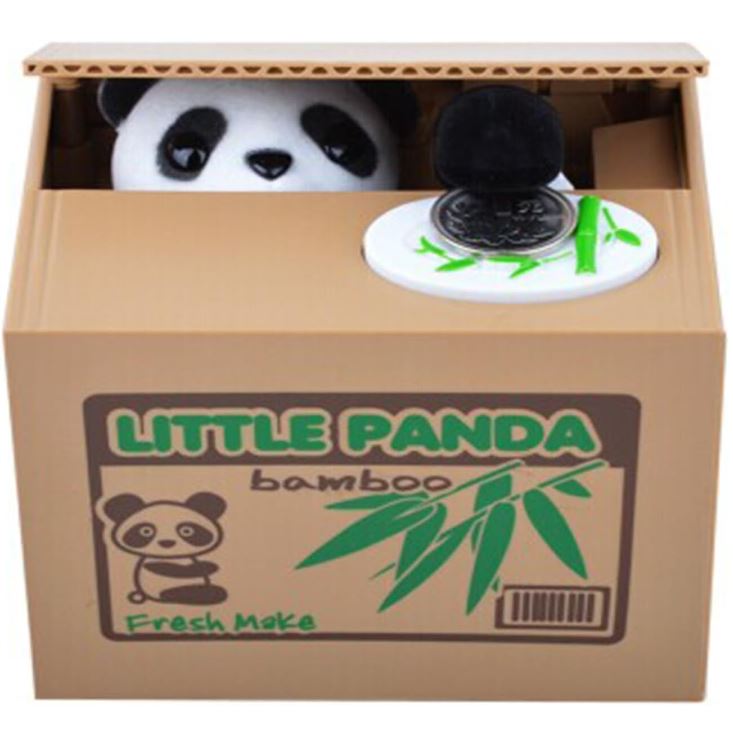

For a child to take on the challenge, it's a good idea to get them a money box that they can open so they can regularly see how much they have saved. Here are some fun options:

A clear money box is a great way for your child to get a sense of progress when it comes to saving money - they can literally see it filling up. This block themed design will delight any LEGO/Duplo fan, comes in a range of colours and it's stackable - no wonder it's a best seller.

You could set a regular time in the calendar to check in on progress and count how much they have managed to save - a great opportunity to start teaching those all-important money lessons.

Variations on the 1p savings challenge

You can easily adapt the challenge to make it work for you. If you think you’ll forget to put aside money every day, or want to save in an online account, you can do the 52-week 1p savings challenge instead. The idea is the same, but instead of putting money aside each day, you tot up the daily savings once a week and put in a lump sum. This means you will need to put in 28p in the first week of the challenge and £25.34 during the last week.

Alternatively, Love Savings Group’s Adrian Yearwood suggests using a round-up scheme which many banks now offer. He says: “There are multiple schemes out there that will automatically round up to the pound and place the rest into your savings. We all know just how many items are priced at x.99p, so why not save one pence each time you buy? Or make more substantial savings on those items priced much less than £1.”

Rachel is a mum of two and a freelance personal finance journalist who has been writing about everything from mortgages to car insurance for over a decade. Rachel went freelance in 2020, just as the pandemic hit, and has since written for numerous websites and national newspapers, including The Mail on Sunday, The Observer, The Sun and Forbes. She is passionate about helping families become more confident with their finances, giving them the tools they need to take control of their money and make savings.

Continue reading

How to save money on food in 2025 - 80+ tips for families

6 clever ways to save for your child's future - the best options to consider

Pros and cons of pocket money - is giving an allowance a good idea?

- Rachel WaitPersonal finance expert