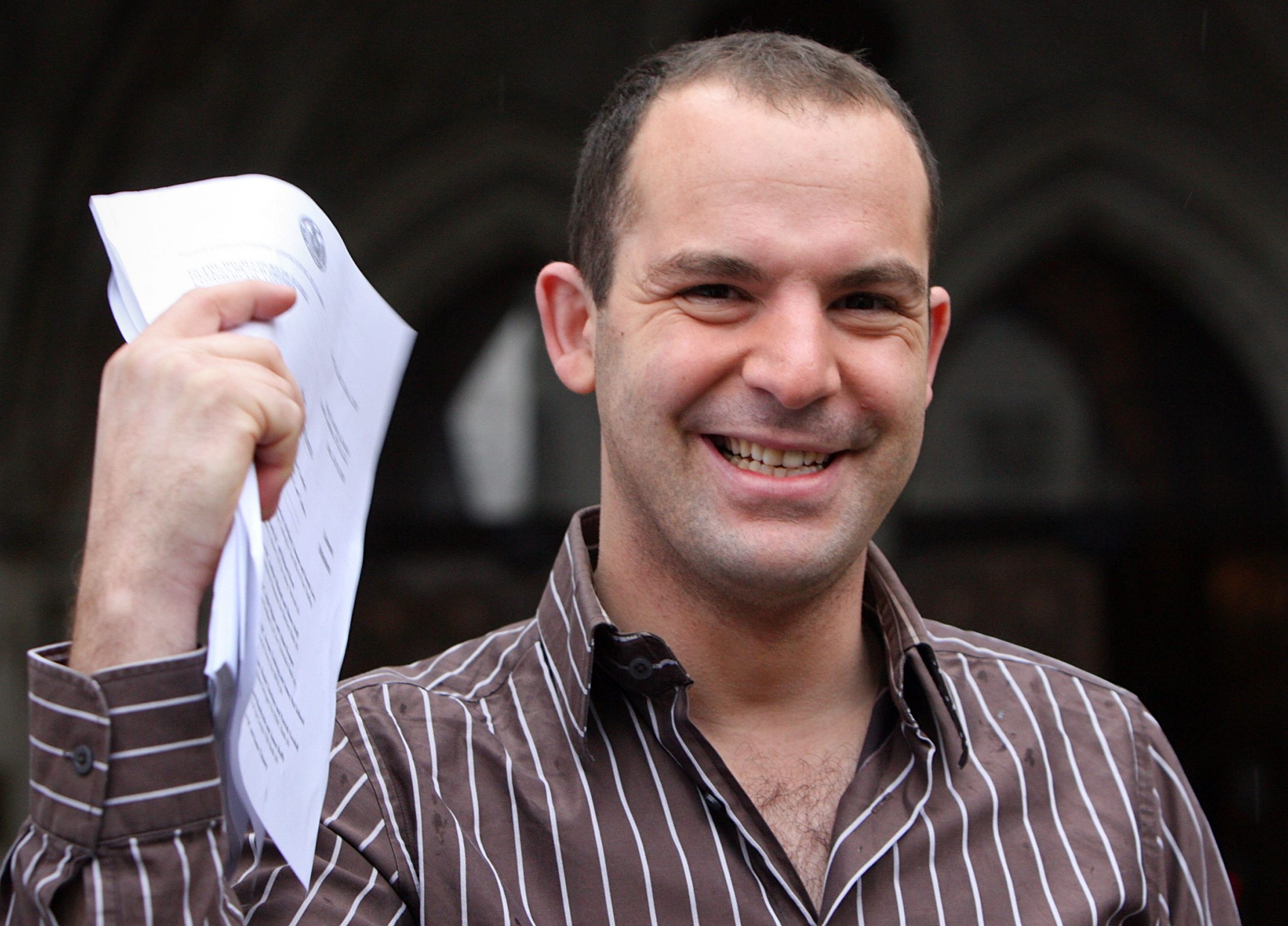

Martin Lewis explains how low-income workers can get a 'hidden' pay rise

Martin Lewis has explained how anyone employed under the age of 22 and on a low income might be eligible for a hidden pay rise.

The Money Saving Expert founder, who recently revealed how you could knock thousands off of your council tax, notes that this is applicable for anyone who meets the criteria and earns less than £10,000 a year or is under the age of 22 as they are not usually included in workplace pensions.

So, what does this really mean? Martin explains, "For those aged under 22 (or over state pension age), or earning under £10,000 a year, the default setting is to be often out of pension auto-enrolment.

"Yet you can choose to be a part of it, and in possibly the majority of cases, your firm can't refuse you".

In certain circumstances, workplaces could be required to contribute to your pension, and if they do not do so automatically, you can request that they do so.

For those that are eligible for workplace contributions and want to participate would effectively receive a pay raise as their employer could offer more money than it would have given previously.

That being said, please note that joining in will reduce the amount of money you get in your paycheck after taxes because it will go into your pension instead.

GoodtoKnow Newsletter

Parenting advice, hot topics, best buys and family finance tips delivered straight to your inbox.

And if you can't afford it right now or have debts to pay off first, then it's not really for you.

Martin also recently shared an easy hack to get essential groceries for free - perfect if you're looking to save money this year. Don't forget, £20 notes expire in 2021, so ensure you spend them before they go out of circulation.

Who is eligible to participate?

Things start to get a little more complicated here. If you are 16 to 21 years old and earn more than £6,240 per year, your employer will encourage you to join and contribute to a pension fund.

Alternatively, you could be eligible for a state pension if you are under 74 years old and earn more than £6,240 per year. If you are between the ages of 16 and 74 and receive less than £6,240, your employer is not required to contribute to your pension, although they do allow you to enter if you wish.

But, you may inquire as to whether your employer would match your contributions. If it doesn't, you might not find it as useful.

How much money can you get?

It is based on a number of factors, including your wages, the amount you contribute to your pension, and the compensation your employer receives.

The money falls out of your salary before taxes are withheld as you save from your pension. This means that putting £50 into your pension per month will cost you £40.

There are limits on how much you and your employer will contribute. You have the option of paying more or having your employer pay a different amount. If you're a basic rate taxpayer who pays in 5% and gets 3% from your employer, you could get £80 a month added to your pension, according to Martin.

Over the course of a year, you'd pay £480 and have £960 applied to your pot. Pension Wise offers free advice to people over the age of 55. Others may make use of The Pensions Advisory Service.

Enrolling in an auto-enrolment scheme will seem unlikely if you are on a low income, but you should do your research and think about how you should plan for retirement.

Since the state pension is unlikely to support your retirement lifestyle, one choice is to secure a pension. The MoneyAdviceService calculator will help you figure out when you'll be eligible for a state pension and how much you'll get paid.

You may want to get a private pension to help you pay for retirement. You may participate in an employer-sponsored programme or create your own. You should also consider how long you plan to work for this company.

Kudzai Chibaduki joined Future as a trainee news writer for Good To, writing about fashion, entertainment, and beauty. She's now a freelance fashion wardrobe stylist and helps direct magazine photoshoots.